In Singapore, there are nearly 190,000 local SMEs, and these make up 99% of all enterprises, contributing to nearly half of the nation’s gross domestic product (GDP), and employing 65% of the workforce here.

According to the Ministry of Trade and Industry, an SME will be defined as an enterprise with an annual sales turnover of under S$100 million, or that employs less than 200 workers.

With that kind of headcount, it is no wonder that accounting and payroll outsourcing companies are in high demand.

As part of the Professional Services, that entire segment is experiencing an annual 4.6% growth rate.

I was part of that many years ago when I was still running a recruitment agency. As a value add, we provided payroll outsourcing services for smaller companies.

These are usually businesses with less than 50 employees or they may have an interim group of people that falls outside of their salary equity structure.

The latter happened when we administered the salaries for a group of PhDs and Professors that were part of a project group at a local statutory board.

And over the years, we experimented with many different payroll software and always had to use workarounds.

You see, most payroll software is meant for the company as a user.

If you are an outsourced provider, you would need to separate the different clients within the software otherwise things can be very messy.

We eventually found something that could do so but it came at a cost.

Even so, the reports it came with is limited since clients demand more from providers

This is why I sat forward and paid attention when I got my hands on KeyPay.

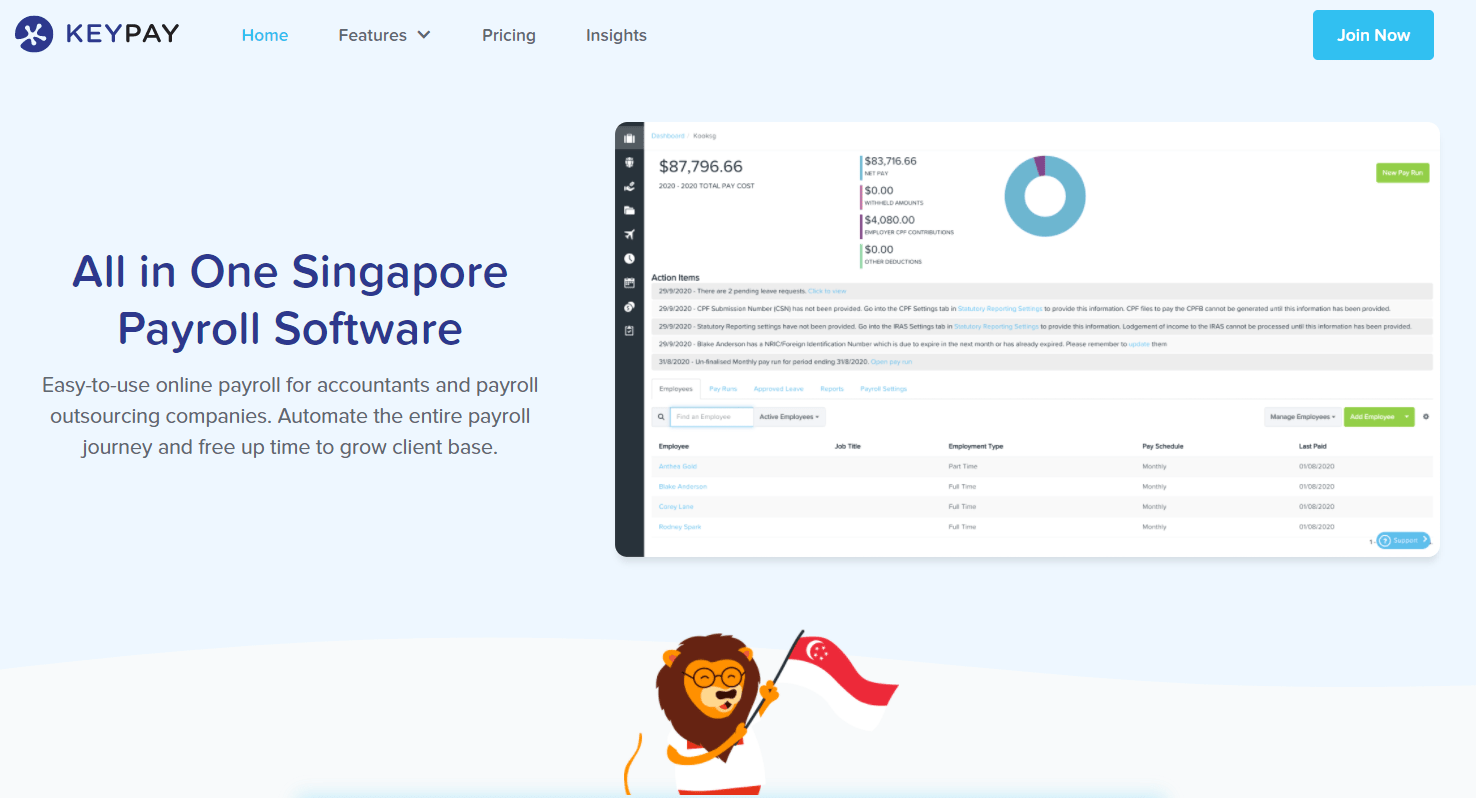

KeyPay is an easy-to-use online payroll software for accountants and payroll outsourcing companies.

It can help providers automate the entire payroll journey and free up time for them to focus on what matters – growing their client base.

In this review, I’m going to do a deep dive into KeyPay and go through their features to show you why they might be the perfect payroll software for accountants and payroll outsourcing companies.

Let’s jump right in.

KeyPay’s Partner Dashboard

Upon login, the first thing you come across is the partner dashboard.

This alone will show you why the software is made for accountants and outsourced payroll companies.

The ability to choose and toggle between entities is crucial to ensure data cleanliness and keep things compartmentalised.

From here, you can easily click on the customers you want to work on.

Automated pay runs feature

One thing I dislike about doing payroll is the kind of repetition especially when this month is similar to the previous.

This doesn’t just involve pay run items but also things like calculations, importing of timesheets and especially the regular report that customers require.

In KeyPay, tasks such as payroll calculations, importing timesheets, and sending reports can be run automatically after a quick one-off configuration.

I get how automation can seem scary because what if things go wrong.

Crawling back the salaries overpayment is not just hard but reputationally damaging.

That is why KeyPay allows you to set up your own red flags. If these are triggered, the automation will be paused.

You do not just save time creating a new pay run (which can add up if you have many customers), you also save time on publishing and notifying employees about their payslips.

Reports

Automation isn’t just on pay runs but also on reporting.

So your clients can automatically receive the reports they need for their finance and reconciliation purposes.

KeyPay comes with an amazing variety of reports.

Over and above the common ones that you see in almost every other software, there are a few that would have made my life so much easier if I had them back when I was still doing payroll outsourcing.

Such as:

Leave Liability Report – so you know how much you may still owe the employee if he/she is to leave and encash their paid leaves.

Withholding Report – If your business has expat employees, you will know why this is important because liability falls onto the employer to ensure they are settled.

Perhaps the most amazing thing is the ability to automatically send out a pack of reports to your clients.

You can define the period, regularity and even include login security so reports will not be opened by others.

Employee portal

Before we look at the employee portal, I must point out this amazing admin feature that allows employees to have their salaries be deposited into more than one bank account.

This is so useful for people who may have a hard time setting aside monies for savings.

From the dashboard, employees can easily access their payslips, leaves, timesheets and rosters.

No more paperwork to handle as everything can be done electronically.

WorkZone – employee self-service mobile app

To cater to the mobile-first employees, there is WorkZone.

This employee self-service app allows users to easily access their leaves and claims, rosters, timesheets and payslips.

Rostering

Not all clients are equal. Some businesses such as food & beverage and retail would have to roster for their employees since they work across multiple shifts across a day.

The built-in rostering feature takes care of that really well since clients can easily create shifts and replicate rosters with just a few clicks.

Rostering errors can also be avoided with availability and approved leave displayed.

And you don’t have to worry about employees overlooking or mistaking their schedules since Key Pay can alert them of their shifts via email, text, or push notifications to KeyPay’s employee mobile app – WorkZone.

Cautious about busting your staffing budget?

KeyPay can alert you once it hits a predefined warning level.

The rosters also display the total cost of employees rostered against the set budget, giving employers an overview of their staffing costs upfront.

Shifts creation and rosters replication can also be done effortlessly with just a few clicks.

Rostering errors are avoided with availability and approved leave displayed.

Time & Attendance

Timesheets are so 2010.

With Clock Me In or WorkZone, timesheets are automatically created when employees clock on/off.

This eliminates human error and saves time.

Besides the ability to import timesheets from other systems such as biometric, I really like the Live View option.

Employers have a bird’s eye view of where their employees are and the time they checked in/out.

Xero integration

Many outsourced accountants are on Xero since it is on the cloud and comes with API for seamless integrations.

KeyPay’s integration with Xero provides one-way data, syncing KeyPay payroll entries to Xero’s journals.

Accounting journal data can be set up to send automatically, with no manual input required, or you can simply click a button to send journal entries over to Xero.

Conclusion

If you are an outsourced accountant or payroll provider, you cannot find anything that is as purpose-built as KeyPay.

They are like what Xero brought to the accountants when it first launched.

KeyPay is the Xero for payroll providers.

This is a sponsored post by KeyPay Singapore.