In the twenty-first century, the business landscape is continuously shaped by relentless technological innovation, shifts in global trends, and, more recently, the unforeseen challenges brought about by the worldwide pandemic. Nowhere is this evolution more apparent than in payroll administration, an area critical to the smooth functioning of businesses worldwide.

At its core, payroll involves the process by which a company pays its employees, which includes accurate calculations of salaries, deductions, benefits, and bonuses and ensuring compliance with various tax regulations. It acts as the pivotal nexus between employees and the financial architecture of an organisation. However, payroll has grown beyond its traditional remit to become an essential cornerstone of strategic business planning, with its complex dynamics deeply intertwined with international labour laws, technological advancement, and economic trends.

The global pandemic has only amplified the role of payroll, challenging the established norms and accelerating the shift towards digitisation. Businesses worldwide have grappled with remote working setups, changing labour laws, and financial instability, impacting payroll dynamics significantly. According to the World Economic Forum (2020), 88% of organisations worldwide encouraged or required their employees to work from home during the pandemic. This shift has altered how we perceive the workplace and affected how organisations manage payroll.

As a direct consequence of these changes, the payroll industry has seen a radical shift in its global dynamics. Managing multi-country payroll has become a more significant challenge, with businesses dealing with diverse local regulations, tax regimes, and multi-currency payment complexities. A recent survey by Deloitte (2022) indicates that 55% of global companies are looking for solutions to streamline their multi-country payroll operations, hinting towards the increasing intricacy of global payroll management.

In light of these changes, there’s an urgent need to explore the future of payroll, underpinned by a thorough understanding of emerging trends, compliance issues, and the role of technological advances. This blog post seeks to navigate these critical areas, providing a comprehensive outlook on the changing payroll landscape.

Emerging Trends in Payroll: Navigating the Path of Disruption

The advent of technology, combined with the evolving workforce dynamics, is driving fundamental shifts in payroll management. Among these, the rising trend of on-demand pay and the emergence of crypto payments and digital wallets have become increasingly prominent, prompting organisations to re-evaluate their payroll strategies.

Rising Trend of On-Demand Pay: An Examination of its Popularity

On-demand pay, a model allowing employees access to their earned wages before the traditional payday, has gained traction, particularly in the United States. Research by PYMNTS revealed that 54% of American workers were interested in real-time or on-demand pay. The reason behind this trend is multi-fold. For employees, the appeal lies in greater financial flexibility, offering relief from cash flow issues and reducing reliance on high-interest debt options like payday loans. For employers, it is an effective tool for employee attraction and retention.

The Emergence of On-Demand Pay in the US and Potential Global Spread

While the popularity of on-demand pay is particularly pronounced in the U.S., it’s gradually gaining global acceptance. The United Kingdom is witnessing a growing demand for flexible pay services. Furthermore, with solid gig economies, Australia is exploring on-demand pay options. This expansion showcases the potential of redefining payroll norms globally.

Crypto Payments and Digital Wallets: The Future of Salary Disbursement

The explosion of digital currencies and wallets is another trend shaping the future of payroll. Despite the regulatory uncertainties surrounding cryptocurrencies, some forward-looking companies are exploring options for salary disbursement through crypto payments. A survey by Gartner noted that 2% of organisations are considering using cryptocurrencies for employee compensation.

Simultaneously, digital wallets are steadily replacing traditional banking methods, driven by convenience, speed, and the global shift towards digital transactions. With most digital wallets supporting multiple currencies and instantaneous transactions, they have a significant potential to simplify multi-country payroll processes.

Government Regulations and Online Payroll Reporting

In the face of these shifts, businesses must adapt to the increasingly complex landscape of government regulations surrounding payroll reporting. A prime example is Australia’s Single Touch Payroll (STP) initiative, which necessitates real-time business payroll reporting. This innovative system provides immediate, streamlined wage and tax data to the Australian Taxation Office each time businesses execute their payroll processes.

This approach to payroll reporting is gaining traction globally. In the UK, Her Majesty’s Revenue and Customs (HMRC) launched the Real-Time Information (RTI) system in 2013 to improve the accuracy and efficiency of the PAYE (Pay As You Earn) system. The RTI initiative requires employers to submit information about tax and other deductions every time they pay their employees rather than at the end of the tax year. This was mainly driven by the need to modernise the tax system and to provide the government with real-time data to respond promptly to economic changes.

Similarly, Singapore introduced the Auto-Inclusion Scheme (AIS) for Employment Income in 2008. Under this system, employers electronically submit their employees’ income information to the Inland Revenue Authority of Singapore (IRAS). The AIS aimed to increase efficiency, reduce errors in tax returns, and ease the process for taxpayers. The introduction of the AIS represents a significant step towards digitalisation, as it offers businesses a more streamlined method of reporting and ensures that taxpayers are taxed correctly based on their exact income.

These paradigm shifts in payroll reporting compel businesses to seek sophisticated payroll solutions capable of real-time data reporting, accentuating the urgent need for digital transformation in payroll.

Digitalisation in Payroll: The Inevitable Shift

As organisations navigate through disruptive trends in payroll, digitalisation emerges as the cornerstone of modern payroll strategies. The ability to automate calculations, ensure real-time accuracy, and streamline compliance requirements have made digitalisation an inevitable shift in payroll management.

Some factors that may make digital payroll adoption more impactful or challenging in Asia include:

- Significant payroll processing is still manual and paper-based in many Asian countries, especially in smaller companies. Digitisation can have an outsized impact.

- Multiple languages and a lack of standardised processes across Asia can make regional consolidation and standardisation of digital payroll more complex.

- Regulatory environments around payroll and taxes vary greatly across Asian countries. Digital systems need more localisation.

- Lower levels of digital infrastructure, internet availability, or tech-savviness in some parts of Asia could slow adoption.

- Large, distributed workforces and high labour mobility in Asia can benefit more from centralised digital payroll.

- Payroll fraud issues in parts of Asia could potentially be reduced through digitisation and automation.

Role of Digitalisation in Streamlining Payroll

Digitalisation has a transformative role in payroll management. By automating routine tasks, digital payroll systems can significantly reduce manual errors, streamline processes, and free up valuable time for strategic activities. Moreover, with integrated analytics, digital payroll systems can provide insightful data on workforce costs and trends, enabling better strategic planning and decision-making.

Countries on the Verge of Full Online Submissions

Many countries are moving towards mandatory online payroll submissions, driven by the need for real-time data and transparency. For example, the UK’s HMRC has made online submissions compulsory for all businesses. Similarly, countries like France, Germany, and Singapore are also moving towards full online payroll submissions. This shift underlines the increasing global trend towards digital payroll systems.

Challenges and Implications for Payroll

Despite the numerous benefits, the transition towards digital payroll has its challenges. Data security, privacy concerns, and adapting to new technologies pose significant hurdles for organisations. Moreover, with digital payroll systems often being cloud-based, ensuring uninterrupted access and dealing with potential downtime are further concerns that must be addressed.

However, these challenges also present opportunities for continuous innovation and improvement in digital payroll solutions, emphasising robust data security, user-friendly interfaces, and reliable service.

Navigating Compliance in a Multi-country, Multi-jurisdiction Environment

In today’s globalised business world, companies often operate across borders, dealing with employees in multiple countries. Consequently, they must grapple with the complex task of ensuring payroll compliance in diverse legal jurisdictions.

Understanding the Complexities of Multi-country Compliance

Navigating multi-country payroll compliance can be a labyrinthine task due to the extensive range of national tax laws, employment regulations, and reporting requirements. In the European Union, businesses must adhere to the General Data Protection Regulation (GDPR), and in the United States, the Fair Labor Standards Act (FLSA) sets the standards. However, the complexity of compliance expands significantly when contemplating multinational operations across such varied regulatory environments.

With its diverse set of economies and regulations, Asia is no exception to these challenges. For instance, in Japan, businesses must understand and comply with the Labour Standards Act, which regulates wages, working hours, and safety. Moreover, ensuring payroll compliance can be particularly challenging with its unique employment practices, such as lifetime employment and seniority-based wages.

In Southeast Asia, each country has its own set of labour laws and regulations. In Singapore, the Employment Act outlines the fundamental terms and conditions for employment, and the Central Provident Fund (CPF) Act governs the mandatory social security savings scheme to which employers must contribute. In the Philippines, the Labor Code outlines the rights and responsibilities of employees and employers, including rules on wages and benefits, work hours, and conditions of employment.

Furthermore, the introduction of Thailand’s Personal Data Protection Act (PDPA) in 2020, similar in some aspects to the EU’s GDPR, has made data handling a crucial part of payroll compliance in the country. The PDPA places stricter controls on collecting, using, and disclosing personal data, and non-compliance can lead to substantial penalties.

As such, navigating the intricacies of payroll compliance in Asia requires a comprehensive understanding of various national laws, and businesses often have to seek the help of professionals or sophisticated payroll solutions to ensure they remain compliant.

The Role of Tax Regulations in Multi-jurisdiction Payroll

Tax regulations are a vital area of compliance in multi-jurisdiction payroll. Each country has unique tax laws that dictate how salaries should be calculated, taxed, and reported. For instance, in Canada, employers must consider federal and provincial tax rates and contributions to the Canada Pension Plan and Employment Insurance. Conversely, in countries like the UAE, where income tax does not exist, payroll management becomes a different challenge.

These complexities underline the importance of robust payroll systems that manage multi-country tax regulations, ensure accurate calculations, and adhere to timely compliance.

The Significance of Data Analytics and Security in Payroll

Data analytics and security play a pivotal role in modern payroll management. With growing digitisation and increasing complexities in compliance and payroll processes, leveraging analytics and safeguarding data have become more critical.

Harnessing Data Analytics for Payroll Optimization

Data analytics can transform payroll from a routine administrative function to a strategic tool. Businesses can gain valuable insights into labour costs, overtime trends, leave patterns, and more by analysing payroll data. This information can inform strategic decisions, from budgeting to workforce planning. A study by Deloitte revealed that 75% of businesses see data analytics as a crucial element in effective payroll management.

Payroll Data Security: Importance and Best Practices

Payroll processes involve handling sensitive employee data, making security a top priority. This concern is further amplified with cloud-based payroll systems, where data is stored remotely. Best practices in payroll data security include encryption, access controls, regular audits, and data breach response plans. Compliance with data protection regulations, such as the EU’s General Data Protection Regulation (GDPR) and Singapore’s Personal Data Protection Act (PDPA), is also crucial.

Single Sign-On and Opt-In Systems

Single Sign-On (SSO) and opt-in systems are increasingly becoming standard digital payroll system features, enhancing user convenience and data security. SSO allows users to access multiple applications with one set of login credentials, simplifying user experience while reducing the risk of password-related security breaches. On the other hand, opt-in systems give employees control over their data, aligning with best practices in data privacy and compliance.

Understanding Multi-Currency Payroll and Payment Processing

As businesses increasingly operate globally, managing payroll in multiple currencies has become a standard requirement. The rise of remote work and the growing globalisation of businesses have amplified this need.

Evolving Role of Multi-Currency Payroll in a Global Economy

In a global economy, multi-currency payroll is more than a complex necessity; it’s an opportunity for businesses to attract and retain international talent and ensure employee satisfaction. However, multi-currency payroll has unique challenges, such as fluctuating exchange rates and varying tax laws. To navigate these complexities, businesses require advanced payroll solutions that can automatically calculate and disburse wages in multiple currencies, all while ensuring regulatory compliance.

Payment Processing: Transitioning from Remote to Generic

Historically, remote payroll strategies have been the norm for multinational companies. These involve having a payroll system in each country, with each handling local compliance. However, with the rise of advanced payroll technologies, businesses are transitioning towards a more generic, unified approach. This strategy allows businesses to manage their global payroll from one platform, driving efficiency, improving compliance, and reducing costs.

This transition, coupled with the rise of digital wallets and online banking, has transformed payment processing in payroll. With these technologies, businesses can quickly disburse wages in any currency, anywhere in the world, providing employees instant access to their earnings.

The Need for a Single, Secure, Unified Platform

The need for a single, secure, unified platform has become paramount with the dynamic changes and increasing complexities in the global payroll landscape. Such platforms offer comprehensive solutions to manage multi-country, multi-currency payroll, ensuring compliance, data security, and user convenience.

Unified Payroll Platforms: The Ultimate Solution for Global Payroll Challenges

Unified payroll platforms provide an integrated solution to address the numerous challenges in managing global payroll. These platforms offer a holistic view of payroll operations by consolidating payroll data from different countries into a single dashboard. This enables seamless multi-country payroll management, real-time payroll costs monitoring, and easier compliance with other tax laws and regulations. Moreover, with features like on-demand pay, crypto payments, and multi-currency processing, unified platforms are equipped to handle future trends in payroll.

Security Aspects of Unified Payroll Platforms

Given the sensitive nature of payroll data, unified payroll platforms must prioritise robust security measures. These may include data encryption, two-factor authentication, role-based access controls, and regular security audits. Furthermore, compliance with data protection laws like GDPR or PDPA is crucial to payroll data security.

Unified Platforms as a Key to Compliance Across Borders

Compliance with various tax laws and payroll regulations is a significant challenge for businesses operating across multiple jurisdictions. Unified payroll platforms can help companies navigate this complexity by automating tax calculations, ensuring accurate reporting, and providing updates on regulation changes. Thus, these platforms play a pivotal role in guaranteeing multi-country compliance.

Conclusion

In the face of evolving trends, regulatory changes, and technological advances, the future of payroll is poised for a transformation unlike any other. Payroll management is transitioning from a routine administrative task to a strategic function influencing businesses’ bottom line and employee satisfaction.

Anticipating the Future of Multi-Currency Payroll: The Role of AI and RPA

Artificial Intelligence (AI) and Robotic Process Automation (RPA) are set to revolutionise the payroll landscape, particularly in multi-currency payroll. AI can streamline complex calculations, predict exchange rate fluctuations, and automate tax compliance, significantly enhancing the efficiency and accuracy of multi-currency payroll. On the other hand, RPA can automate repetitive tasks, reducing errors and freeing up time for strategic activities.

The Value Proposition of a Single, Unifying Platform: Merging Payroll Operations with Technology

A single, unifying payroll platform emerges as the ultimate solution to meet the future challenges of payroll. By consolidating payroll processes into a unified system, businesses can seamlessly manage multi-country, multi-currency payroll, ensuring compliance, data security, and user convenience. Moreover, with integrated analytics, these platforms can transform payroll data into strategic insights, driving better business decisions.

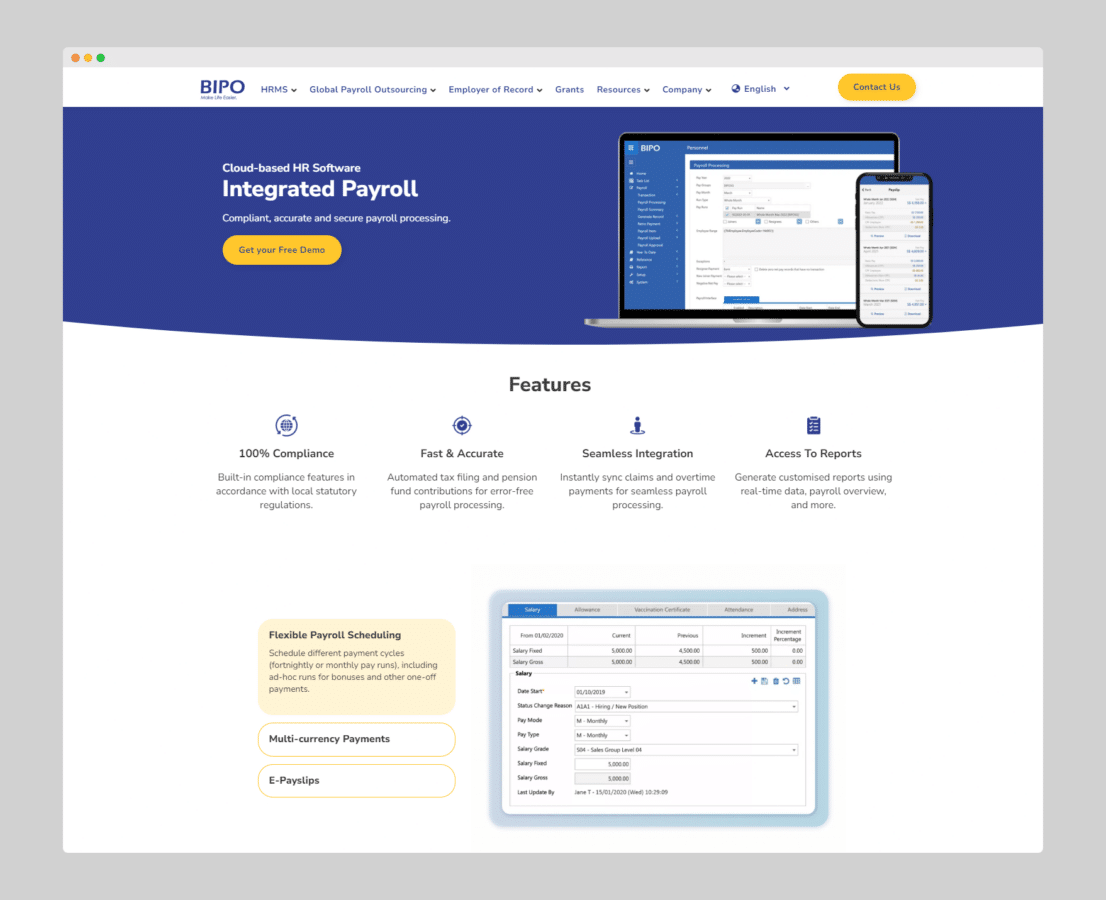

BIPO’s Offerings: Aligning with Future Payroll Trends

BIPO is at the forefront of the evolving payroll landscape. Their unified platform leverages state-of-the-art technologies to deliver comprehensive, secure, intuitive payroll solutions. With their robust capabilities in multi-currency processing and multi-country payroll management, BIPO’s offerings are precisely engineered to meet the ever-changing needs of global businesses.

Key to their offering is a strong focus on compliance management. Understanding the intricacies of diverse regulatory environments, BIPO ensures seamless integration of statutory compliance measures into their platform, making multi-country payroll compliance less of a hassle and more of a streamlined process.

As we venture into these transformative times, one certainty prevails: The future of payroll is here and now, characterised by a more dynamic, efficient, and strategic approach than ever before. With BIPO, businesses can confidently meet this future head-on, primed for success in any corner of the globe.